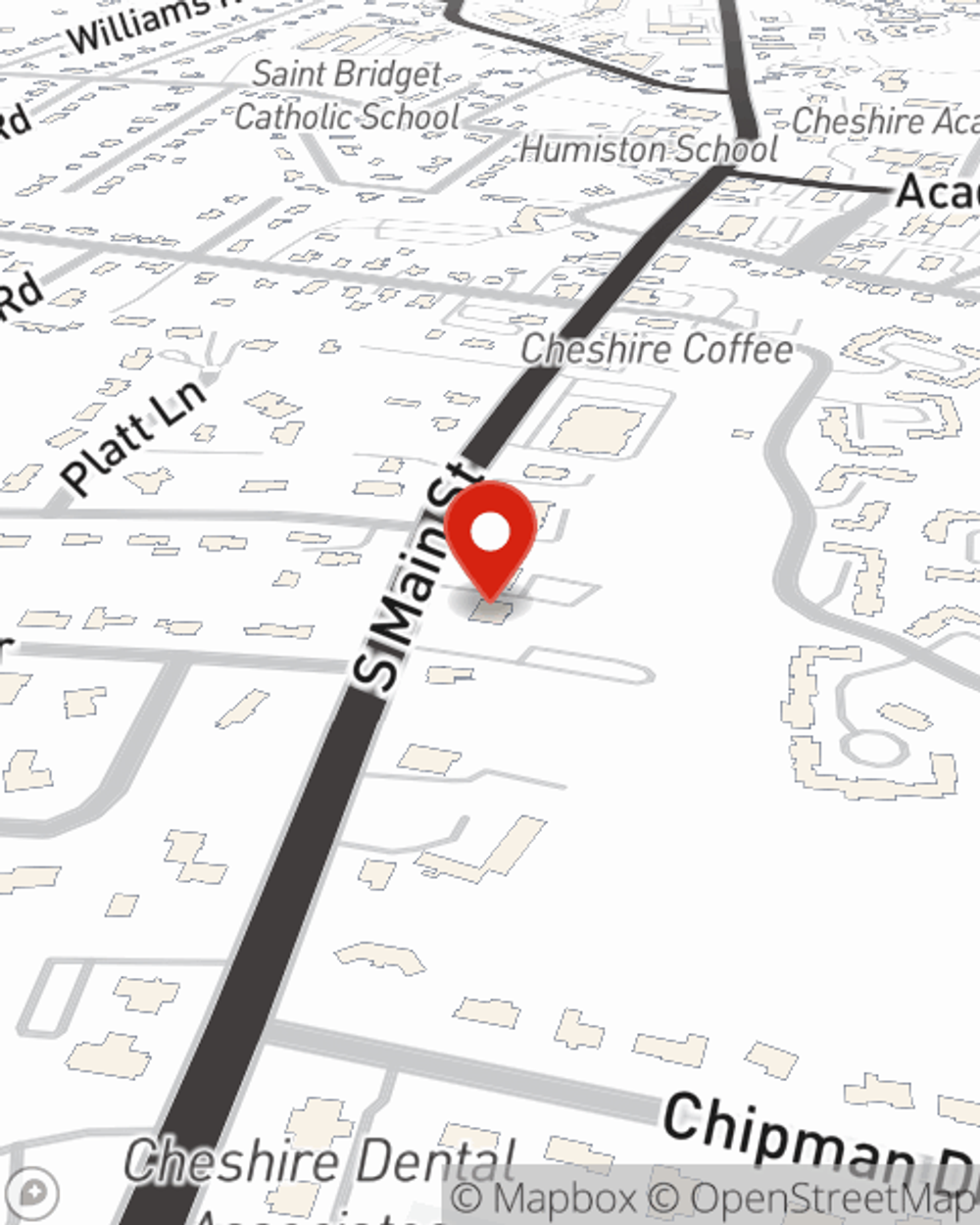

Business Insurance in and around Cheshire

Searching for insurance for your business? Look no further than State Farm agent Derek Gromko!

Helping insure small businesses since 1935

Your Search For Reliable Small Business Insurance Ends Now.

Do you own a tailoring service, a confectionary or a pharmacy? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on making this adventure a success.

Searching for insurance for your business? Look no further than State Farm agent Derek Gromko!

Helping insure small businesses since 1935

Surprisingly Great Insurance

Every small business is unique and faces a wide array of challenges. Whether you are growing a candy store or an acting school, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Derek Gromko can help with extra liability coverage as well as key employee insurance.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Derek Gromko's team to review the options specifically available to you!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Derek Gromko

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.